“You can now buy a Tesla with Bitcoin” .

The iconic announcement from Tesla’s CEO and Bitcoin-enthusiast, Elon Musk earlier this year created a multitude of knock-on effects in the cryptocurrency market.

From an influx of new investors dipping their toes into the cryptocurrency realm to considerably more retailers thinking of adopting this form of alternative digital payment. Why? To get their piece of share in this evergrowing trend.

If you’re interested in learning about cryptocurrency payment in ecommerce, what its potential benefits and drawbacks are, you are in the right place.

What is Cryptocurrency?

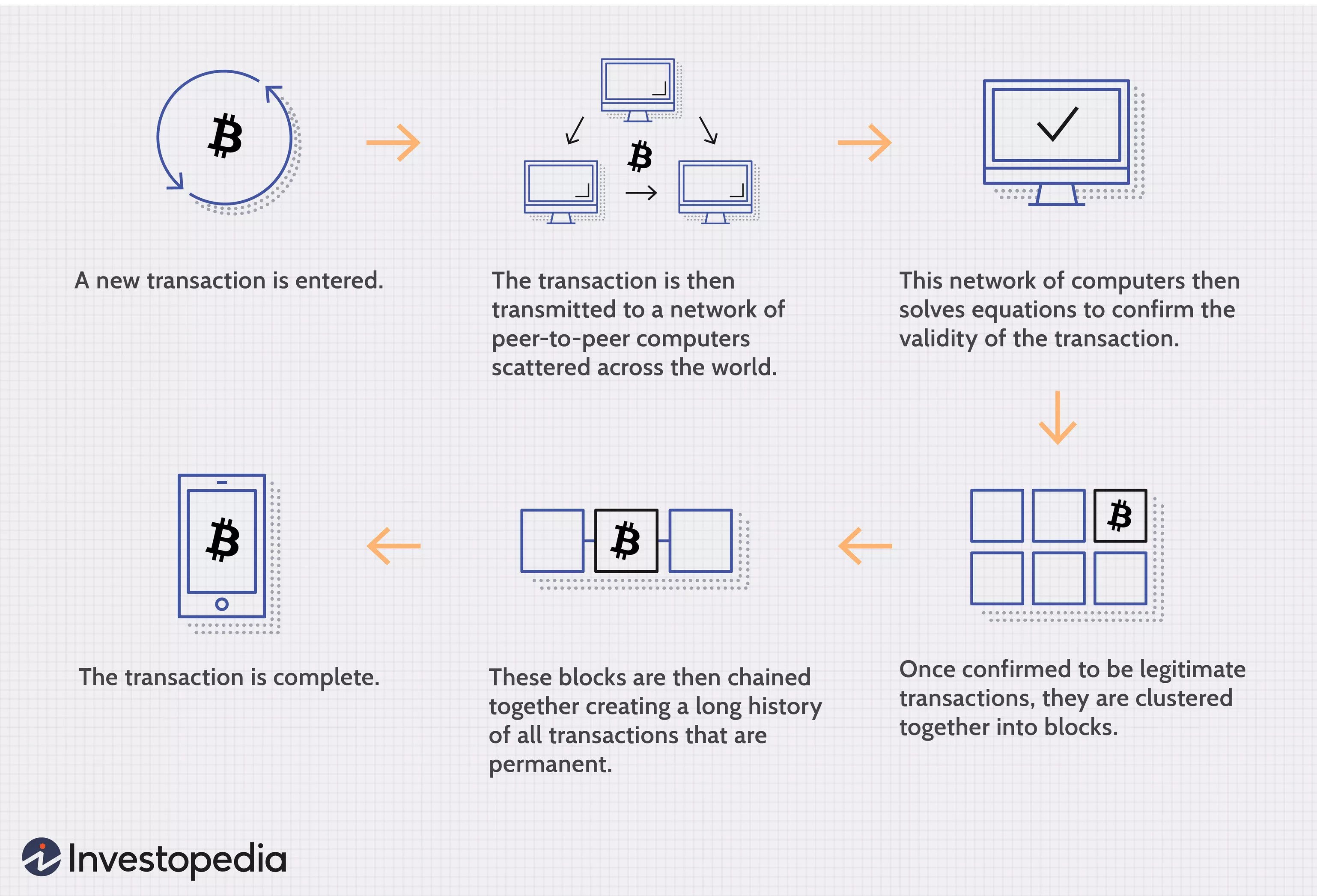

Simply put, cryptocurrency is a network of peer-to-peer digital payment systems that don’t have a centralized system for final authorization, verification, and monitorization of transactions.

Similar to the stock market, its asset value is variable. However, cryptocurrency comes in the form of complex encryption using “distributed ledger technology” such as blockchain-based technology, which is essentially the record-keeping technology behind most cryptocurrencies.

Since the launch of Bitcoin in 2009 , more than 4,000 cryptocurrencies have entered the game to date. Ethereum, Litecoin, Ripple, and Dogecoin (based on a popular meme) are amongst the top five most popular types of cryptocurrencies.

In e-commerce, cryptocurrency in transactions works in two ways: consumers can choose to pay via their personal digital wallet or through a third-party payment service (such as PayPal) that is linked to the retailer’s online store.

The Rise of Cryptocurrency as a Form of Ecommerce Payment

While cryptocurrency has captured the attention of many investors, retailers have also been keeping a close eye on this trend. For example, PayPal launched “Checkout with Crypto” earlier this year to US consumers by converting their cryptocurrencies to dollars and euros without transaction fees allowing efficient and streamlined ecommerce transactions.

In 2017, Beauty giant Lush adopted cryptocurrencies as a form of digital payment on their website via the BitPay app. What’s more? According to Deloitte, more than 2,000 US businesses have started to accept Bitcoin since 2020.

Aside from the rise in cryptocurrency investment, Forbes reported its transparency, lower cost, and efficiency as a payment method is one of the reasons why this form of digital payment has catapulted in ecommerce payment by merchants. With ecommerce expected to account for over $5.69 trillion in sales by 2022, the winners will be those who can keep up with evergrowing consumer demands in all areas of their operations.

The Benefits and Drawbacks of Cryptocurrency as an Online Payment Method

Benefits:

1. Faster transactions

Unlike other forms of payment with a central authority, cryptocurrencies tend to be processed immediately, giving the merchant fast access to the transaction. For businesses, this can improve cash flow and allow it to be applied to other business areas. For consumers, this aligns with the on-demand economy concept where consumers are less patient and require almost immediate results. For example, an almost immediate transaction can mean faster shipping as orders are processed quicker.

2. Wider potential customer pool

Millennials and Gen Zs account for the most rapid adopters in cryptocurrency investment which presents a unique opportunity to expand your business reach. As they are one of the most digitally savvy generations, accurately targeting them with what they expect will give you an advantage. For example, one way could be offering the online payment option of cryptocurrencies on top of credit cards and a buy-now-pay-later opportunity to appeal better to them.

3. Less expensive

Cryptocurrencies have minimal transaction fees , which makes them an attractive option for e-retailers to consider. For example, payment platform Stripe charges around 3-5% on each credit card transaction, whereas cryptocurrency charges significantly less and can even go down to 1% per transaction. Lower operational costs can potentially improve profitability as the cost per transaction fee is lowered.

Drawbacks:

1. Volatility

Skeptics of cryptocurrency note its extreme volatility as a key reason why even traditional stock market investors have not yet adopted cryptocurrency in their portfolios. Without a central authority to regulate the rate at which the value rises and falls, the behavior of cryptocurrencies tends to be more difficult to predict and harder for businesses to plan their operations.

For example, earlier this year, Elon Musk’s Dogecoin joke on Saturday Night Live caused a massive drop of 30% per share , indicating this form of digital currency as potentially too easily influenced.

Alternatively, a challenge that businesses may face could be when customers return a product bought from their ecommerce store. If the value of the crypto coins used to pay for a product falls, would the amount refunded be the same as the original value during purchase or be deducted?

The cryptocurrency market as we know it is immensely fast-changing. This volatility makes it harder for smaller ecommerce businesses that accept this type of digital currency to process refunds. For example, there is a high possibility that customers will expect the reimbursed amount to match the initial market value of the crypto coin they paid with which may rein into the business’s operating margins if the value has dropped but the same amount as initial needs to be paid back.

2. Lack of consumer protection

With traditional digital payment methods such as credit cards, consumers know they have dedicated support if problems such as fraud occur. Whereas, with cryptocurrency, there is virtually no consumer protection.

Without a consensus on how the crypto coin’s value is calculated amongst volatility, the e-retailer is not obligated to pay the same value as the initial purchase. This grey area could potentially hurt a business’s reputation as consumers feel they are not protected, which can have a knock-on effect on consumer loyalty in the long run.

3. Disunified cashflow / Cashflow fragmentation

Not everyone in your business may accept cryptocurrencies, whether it be suppliers or even employees who may prefer cash or bank transfers. This lack of unity between what customers want and what a business can provide can be challenging to manage and, thus, problematic. Moreover, as the value of cryptocurrency fluctuates so easily, it may lead to adverse losses without careful monitoring of the markets.

So, What Can We Expect in the Future?

With the rate cryptocurrencies are infiltrating the ecommerce industry, one can expect this form of digital payment to become a crucial part of your full ecommerce strategy soon. Businesses that adopt this payment method can stay ahead of the game – especially for those operating an ecommerce platform that deals directly with consumers (DTC).

For ecommerce retailers looking for an opportunity to expand their target market reach, offering an alternative way of payment in line with digital-savvy expectations could be just the answer you were looking for.

As cryptocurrency adoption into ecommerce continues to increase with uncertainties – popular, well-established payment gateways such as PayPal have everything you need for rapid implementation. Currently, Paypal’s Checkout With Crypto is only available for consumers in the US, whereas alternative payment gateway competitor BitPay, is available in 229 countries – tested by retailers across several industries, including big names such as Tesco, Marks and Spencer, and Lush.

Based on the positive trends and potential growth outlook, we can assume that cryptocurrency payments will soon be easily accessible worldwide. With technologies already available, businesses of any size or industry can quickly adopt and implement this relatively new payment concept.

Consult with our team of ecommerce experts today and explore the possibilities to take your business to the next level.